Maximize your client’s tax benefits before the January 1, 2017 life insurance tax changes.

It has been a long time since there have been major life insurance tax changes in Canada. That’s all about to change with the introduction of new exempt test rules for life insurance policies. The new legislation reflects current mortality rates, new insurance product design, and heightened requirements for standardization across insurers and products. The new rules replace the current and more favourable rules which remain in place until the end of 2016. Below are the details of the most significant new life insurance tax changes:

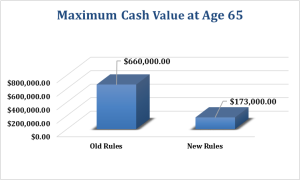

Change #1 – Reduction in Maximum Cash Value – Impacts permanent insurance, with minimum lifetime premiums.

Put simply, the Canada Revenue Agency (CRA) and Department of Finance don’t want life insurance policies used as an investment. After 2016, cash values will be allowed but at lower levels. The effect is similar to a reduced annual contribution limit to $5,000 for RRSPs.

The exact amount of reduction in maximum cash value is age and year dependent. Estimates show that a 65 year-old male would have a long-term reduction in maximum cash value of 75%.

This change will impact business owners with holding companies which have retained earnings and are looking to diversify into a tax advantaged asset. Life insurance policies enjoy the benefit of having investment earnings exempt from accrual taxation. Especially on high rate investments such as GICs, the compounding affect is substantial.

Change #2 – Reduction in Capital Dividend Account Credits – Impacts a corporation receiving life insurance proceeds to fund a shareholder buy sell, tax liabilities or estate bequests

Capital dividend account (CDA) credits are created when a corporation receives life insurance proceeds. These credits are very valuable because they allow for the distribution of tax-free dividends. The credits created are equal to the insurance proceeds less the policy’s adjusted cost base (ACB).

The new 2017 ACB calculations will result in higher ACBs for longer periods of time. The change is primarily due to the updating of life insurance mortality tables taking into account current and longer life expectancies.

Annual mortality is one factor in the calculation of the policy’s ACB and generally we can calculate the ACB as the cumulative premiums less the cumulative mortality.

This is a good result if cash value is to be withdrawn as tax is paid on the cash value in excess of the ACB. However, this is a negative result for corporations looking to create capital dividend account (CDA) credits.

By reviewing current life insurance needs and in-force policies, our business insurance specialists can help your clients establish the best protection for their wealth and cash flow against the impact of these new tax rules.

Change #3 – Increase in Minimum Premiums for Term 100/LCOI Policies – Impacts permanent insurance, with minimum lifetime premiums.

There are multiple changes to the income tax legislation resulting in an increase in Term 100 or Level Cost of Insurance (LCOI) premiums. This change impacts those who want permanent life insurance at a minimum lifetime premium. While the legislation changes are complicated, a breakdown of the changes and results are below.

To understand the changes, it is important to first understand the product design. Mortality has an increasing curve-the older you get the more likely you are to die. But Term 100 or LCOI policies levelize the curve and overcharge mortality in the early years while undercharging in the later years. This over payment creates a cash value reserve that is imbedded inside the policy. This reserve currently does not form part of the policy cash value.

The new 2017 rules will require the reserve to be part of the policy cash value. While the final product designs for 2017 are not yet known, we can anticipate a few consequences of this change.

- The inclusion of the reserve will limit the amount of additional funds that can be invested inside the policy

- The reserve will be subject to investment income tax and the additional investment income tax will be passed onto policy holders

- Insurance companies may take the approach of making the imbedded reserve available to the policyholder. As this reserve is factored into the product’s pricing, it would be logical to assume that this would lead to a further increase in premium

Change #4 – Increase in Funding Duration – Impacts those looking to fund a policy as quickly as possible to take advantage of the tax sheltered growth.

Federal Finance and CRA don’t want life insurance used as an investment. The new tax rules tighten up the rules written into the 1982 legislation which govern policy funding.

Currently, a policy can be funded with a premium duration as low as 1 year (3 – 4 years is more typical). This is ideal for those looking to fund the policy as quickly as possible to take advantage of tax exempt growth or for simplicity purposes (e.g. don’t want to pay ongoing annual premiums).

It is expected that the new rules will increase the minimum premium duration to 8 years. This will have the effect of reducing the tax exempt growth in the early years and extending the number of years premiums are paid. This change primarily affects universal life. Whole life is also affected where large additional deposit amounts are used.

By reviewing current life insurance needs and in-force policies, our business insurance specialists can help establish the best protection for wealth and cash flow against the impact of these new tax rules.

By reviewing current life insurance needs and in-force policies, our business insurance specialists can help establish the best protection for wealth and cash flow against the impact of these new tax rules.